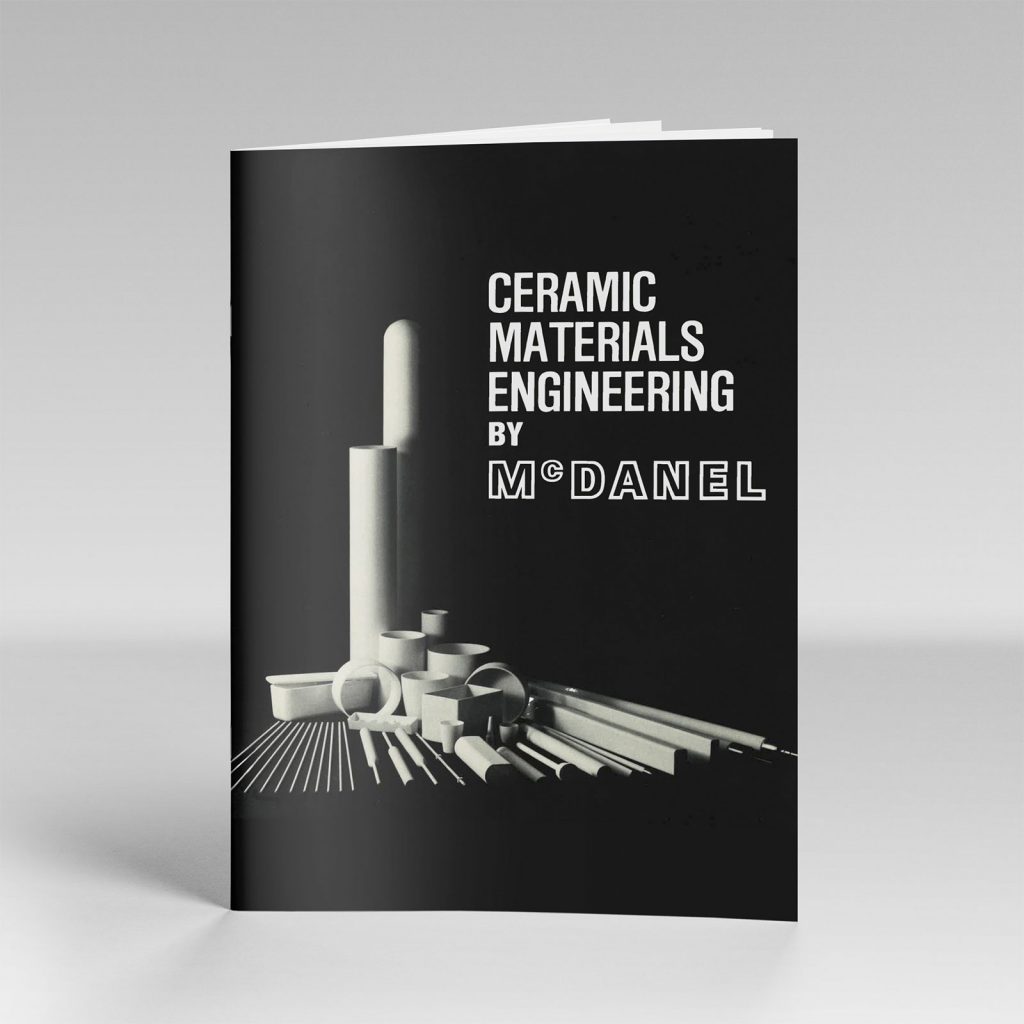

ABOUT McDANEL

History

1919

McDanel Refractory Porcelain Company founded in Beaver Falls, PA by Walter McDanel and owned by 3 generations of the McDanel Family

1947

After WWII, McDanel became a domestic source of ceramic thermocouple insulators and protection tubes.

1950s

Over the years, the company grew by developing its manufacturing capabilities which allowed them to sell into a variety of industrial applications.

1950s

The company’s reputation within the Technical Ceramic markets grew and the McDanel name became a strong brand within the USA.

1960s

Some key product developments included: Fused Silica rollers for annealing lehrs and glass tempering furnaces, fused silica shrouds for continuous casting of steel, dental implants, & continuous extrusion process for smokeless cigarette filters.

1989

Vesuvius – a subsidiary of British Cookson Group plc – acquired McDanel and renamed the company Vesuvius McDanel

1989-94

McDanel was part of the Technical Ceramics Sector within Vesuvius, and during this period of time, several new products were added to the portfolio – Accumetrix Thermocouple Assemblies, Argon Purge Tubes, SIALON and SIALON BN components, and Indium Tin Oxide Sputtering Targets for PVD Systems.

1995-2000

With Vesuvius, McDanel focuses on Refractory Ceramic Fiber Rolls used for LCD Glass Manufacturing and Fused Silica Crucibles for Solar Cell Manufacturing

2005-10

McDanel Advanced Ceramic Technologies is sold and reborn with significant growth and industry focus

2011

Vesuvius removed its Accumetrix Thermocouple assembly line from MACT and reduced purge tube purchases.

2013

Over this time period, we have focused on product development, enhancing extrusion capabilities, and increasing our technical staffing in production, sales, and R&D.

2022

McDanel sets course for a new growth path becoming an Artemis Company

2024

Responding to customer demands, McDanel significantly expands its capacity by acquiring Rayotek Scientific, the industry leader for single-source advanced glass and sapphire solutions.

The McDanel Story

McDanel Advanced Ceramic Technologies (MACT) continues to prosper during a fourth distinct period of ownership in its 104-year history.

Highlights

- The first period spanned 70 years from the establishment of the company as McDanel Refractory Porcelain Company (MRPC) in 1919 until its acquisition by Vesuvius (part of British company Cookson Group plc) in July 1989. During that first period it was privately owned by three successive generations of the McDanel family.

- The second period, as Vesuvius McDanel, lasted almost exactly 16 years i.e. from July 1989 until June 2005.

From June of 2005 until September of 2022 i.e., 17+ years, the company operated as McDanel Advanced Ceramic Technologies (MACT) under the principal ownership of Mr. Roberto Grosso who, interestingly, was the president of Vesuvius at the time the company was acquired by them in 1989. - Artemis Capital Partners acquired the company in September 2022.

- McDanel acquires Rayotek Scientific, the industry leader for single-source glass and sapphire solutions.

McDanel Refractory Porcelain Company (MRPC)

1919-1989

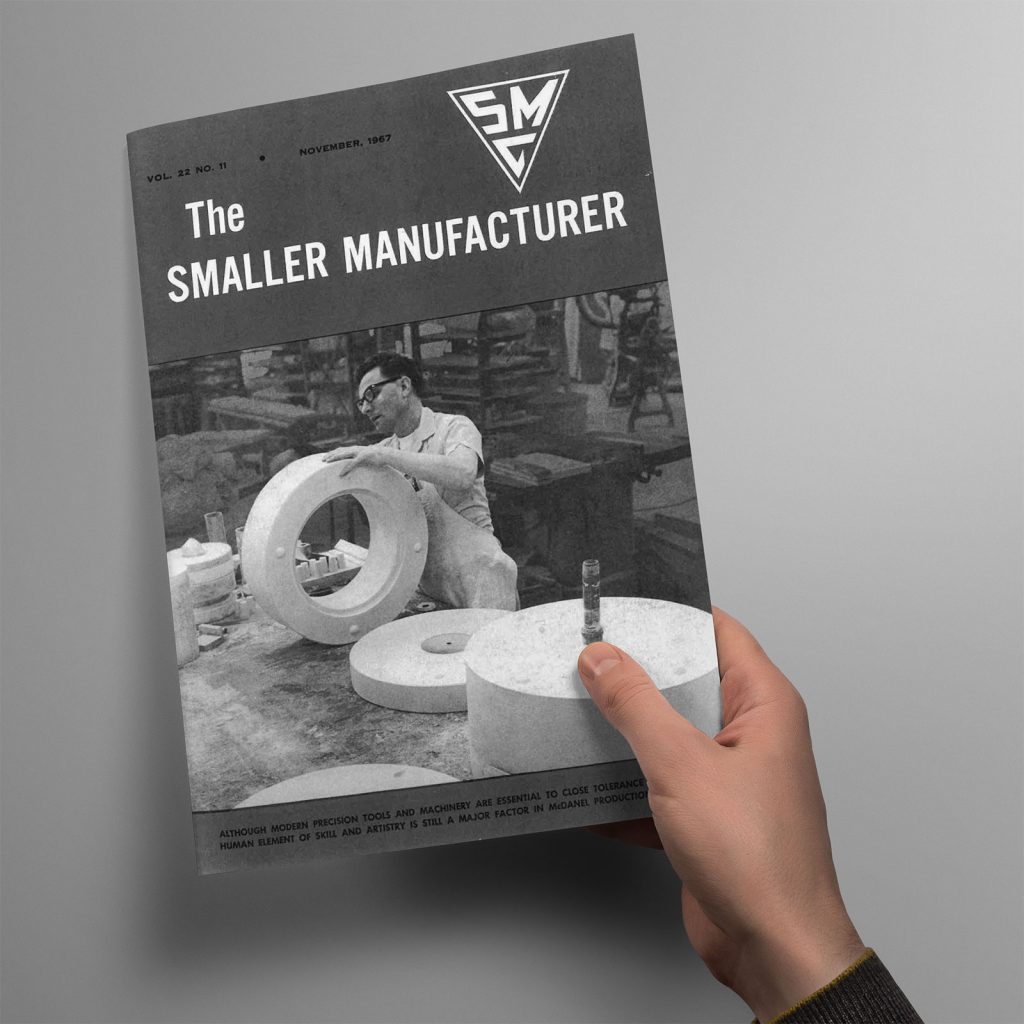

During the first world war, the National Bureau of Standards (NBS ) operated a ‘field laboratory’ in Pittsburgh and activities there included developing processes and even operating production facilities for providing products which had become difficult or even impossible to obtain because of the war. One of those products was ceramic thermocouple protection tubing which had formerly been imported from Germany.

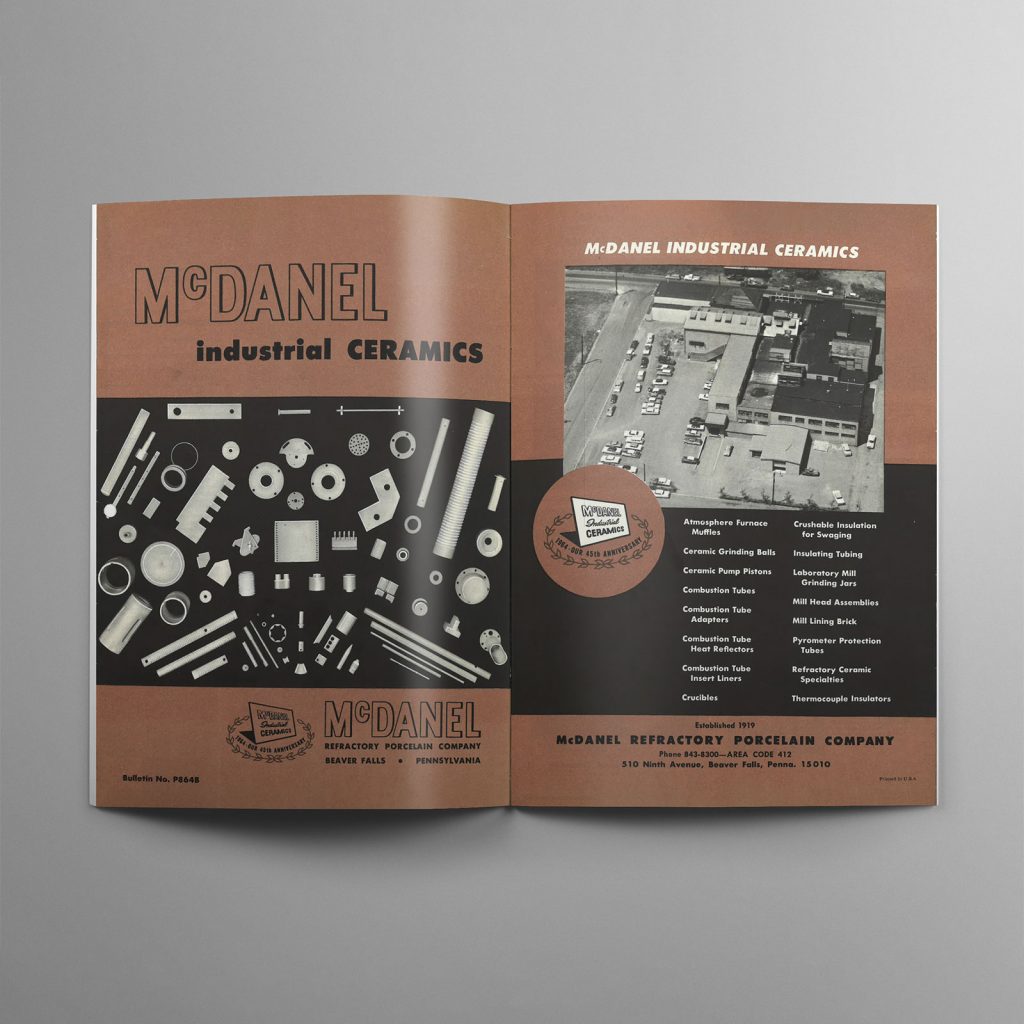

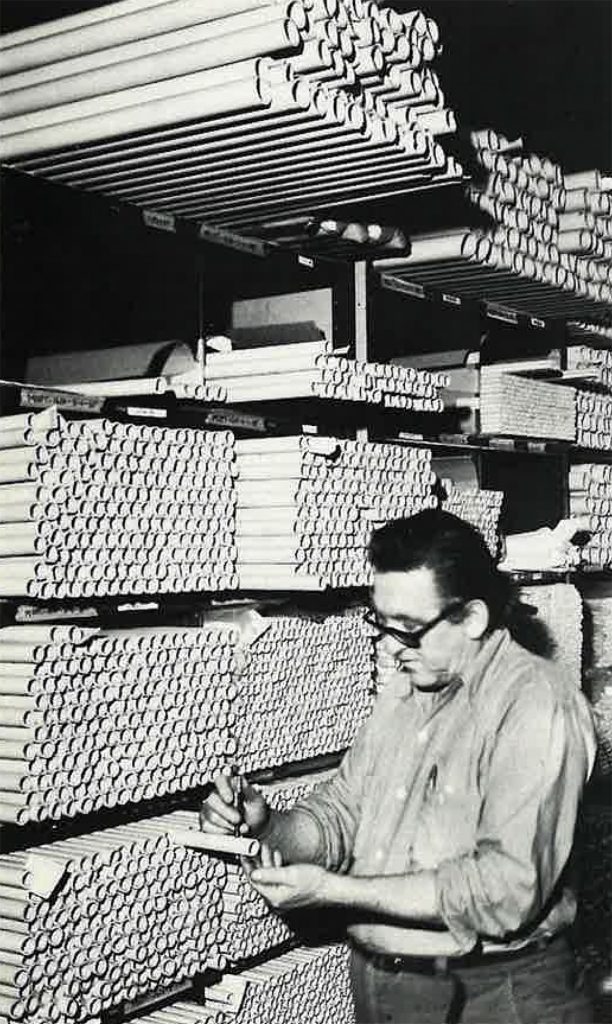

The mold maker who worked on the project at the NBS in Pittsburgh was a McDanel and after the war ended he was encouraged to set up his own business to manufacture these products in Beaver Falls PA and the McDanel Refractory Porcelain Company came into being. Over the years the MRPC expanded its materials offerings and its products from small thermocouple protection sheaths (TCSs) and insulators to crucibles, laboratory ware, large furnace tubes etc.

The last McDanel family member to own the company was the first college-educated ceramic engineer. He had the foresight to hire several fellow ceramic engineers as president and as research/process engineers which ushered in a period of expansion, not only as a result of increased sales of mullite and high-alumina ceramic products but also the introduction of new materials and products such as re-bonded fused silica for steel pouring nozzles and rollers for roller hearth furnaces in the glass industry and stabilized zirconia for use in industrial oxygen sensors.

It is worth mentioning that at the time of the purchase of McDanel by Vesuvius in 1989, with the exception of small-diameter extruded insulators for use in thermocouples/sensors and a small number of iso-pressed alumina tubes for specialist applications, all McDanel products were manufactured by slip-casting. This is despite the fact that the company had been very early investigators into diverse activities such as the use of alumina ceramics as dental implants (by injection molding) and carbon filters for smokeless cigarettes (by extrusion). However, as a small, family owned business they were extremely risk averse and decided not to diversify into either product, which in hindsight was probably a smart move since in both cases it took much larger companies a decade or more to develop products worthy of commercialization.

Vesuvius McDanel

1989-2005

The acquisition of McDanel by Vesuvius in 1989 made perfect strategic sense. At that time Vesuvius was expanding its global fused silica market share and McDanel was significant competitor for such products in North America. In addition, Vesuvius and parent company Cookson Group had already made a strategic decision to enter the technical ceramics market and during the previous year had acquired a small company in the UK from Coorstek.

The acquisition of McDanel not only brought market share, manufacturing capacity and know-how to bear on Vesuvius’ North American fused silica ambitions but also a profitable technical ceramics activity with materials and manufacturing processes complementary to the newly acquired business in the UK. The new management team was considered capable of helping Vesuvius expand its new Technical Ceramics Sector through a combination of further strategic acquisitions and organic growth. This approach worked well for a while but unfortunately the timing turned out to be less than ideal.

In 1990 Vesuvius’ parent company, Cookson Group, ran into financial difficulties due to being ‘over geared’ at a time of contracting global industrial markets compounded by mounting pressure to comply with progressively tighter environmental regulations. Consequently, Vesuvius’ plans to grow the fledgling technical ceramics sector to the point of having a critical mass of materials and processing technologies were largely curtailed. By mid-1993, after Vesuvius had added two more small companies to its technical ceramics sector and had at least two more potential acquisitions ‘in the wings’, the parent company, Cookson Group, ‘pulled the plug’ by first deciding not to finance any further technical ceramics acquisitions and furthermore to divest Vesuvius’ existing technical ceramics interests in order for it to be able to focus on its ‘core’ refractories businesses.

By the end of 1994 only McDanel had survived and remained part of Vesuvius for 10 more years, largely because McDanel’s only coarse-grained refractory product i.e. fused silica (Zyarock) had expanded to include large crucibles used in the production of polycrystalline silicon for the growing photovoltaics market and because it had developed a process for making large, ceramic fiber-based rolls used in manufacturing the thin glass sheets needed by the various burgeoning flat panel display technologies.

Vesuvius McDanel Product Innovation

During its time in the Vesuvius world, McDanel was intimately involved in the development and commercialization of a significant number of new products, including:

- Plasma-spray coated ladles for aluminum die-casters. (Sold through the Vesuvius Foundry Products Division).

- Si/Al cylindrical magnetron sputtering targets made by plasma spraying. (Sold through the Cookson Electronic Materials Division).

- Zirconia susceptor tubes used in the production of optical fiber. (Sold directly by McDanel but eventually replaced by competitor’s graphite tubes)

- Thermocouple assemblies (Accumetrix) used for continuous temperature measurement in molten steel. (Sold into the Vesuvius Steel Division).

- Indium Tin Oxide (ITO) magnetron sputtering targets. (Sold through the Cookson Electronic Materials Division and eventually transferred to one of their locations).

- Large fused silica (Zyarock) crucibles for polycrystalline silicon manufacturing. (Sold directly by McDanel until manufacturing transferred to new bespoke Vesuvius location in the Czech Republic)

- Large fiber-reinforced rolls (Zyalite and Zyacil) used in production of LCD glass. (Sold directly by

McDanel until manufacturing was relocated to Vesuvius facilities in Japan and South Carolina) - Slotted tubes made from recrystallized 99.8% alumina (RCA) for argon purging systems. (Sold into the Vesuvius Steel Division).

- Sialon-BN break rings and side dams used in continuous casting of steel. (Sold into the Vesuvius Steel Division).

- Slip-cast sialon TCSs (Sold into the Vesuvius Foundry Products Division).

Most of the new products developed by McDanel during the Vesuvius era were eventually transferred to other Vesuvius or Cookson locations – either while McDanel was still owned by Vesuvius, at the time of the subsequent sale to Mr. Grosso or at the end of a five-year grace period.

McDanel Advanced Ceramic Technologies (MACT)

2005-2022

In 2005, Roberto Grosso acquired the technical ceramics component of Vesuvius McDanel plus an agreement by Vesuvius to continue purchasing Accumetrix thermocouples and slotted RCA purge tubes (collectively worth over $3M in sales revenue) from McDanel for a period of 5 years after the sale. Understandably, the technical ceramics activity of McDanel had been largely neglected by Vesuvius since the dissolution of its technical ceramics sector in 1994. The new company (MACT) was tasked with rejuvenating its traditional technical ceramics business.

It was soon recognized that, as a supplier of tubular technical ceramics, McDanel’s strong reliance on slip-casting as a forming method was a weakness. Slip casting certainly had and still has a place but in many cases offers no advantage over the inherently lower-cost extrusion process. It was felt that during the Vesuvius era McDanel had lost ground in some of its core applications (e.g. thermocouple protection) and certainly would never be able to compete outside of the USA with European competitors already manufacturing similar products by extrusion. Consequently, one of the first strategic decisions made was to invest in the development and expansion of the extrusion process. The initial interest was in being able to offer lower-cost extruded 99.8% alumina closed-end tubes (TCSs – typically <25 mm diameter). Subsequently an opportunity arose to supply larger diameter (85 mm) open-ended mullite tubes for a solar cell processing application (thin-film on glass) and a significant amount of effort was expended in that direction too.

Fortunately, however, there was a very strong bounce back in demand during 2010. This recovery was fueled in large part by a surge in demand from the solar industry – ironically for slip-cast zirconia and alumina TCSs used in solar silicon manufacturing furnaces. Unfortunately the demand was short lived. The solar industry crashed mid- 2011 and annual sales of slip cast zirconia and alumina TCSs plummeted.

Vesuvius withdrew their Accumetrix product line from MACT during 2011 and in 2012 significantly reduced their purchases of RCA purge tubes, resulting in a dip in MACT revenue.

Since 2012, however, MACT again began to experience growth, largely due to focusing its attention on Wearguard and Sialon, which were recognized as having above average sales growth potential. This focus on these two product groups required significant engineering and sales development efforts, but the results were very positive.

McDanel Advanced Ceramic Technologies (MACT) — as part of Artemis Capital Partners

2022-2024

In September 2022, MACT was acquired by Artemis. Since then, the emphasis has turned towards rapidly growing and strengthening the business in the following ways:

- Hiring and training additional high-potential individuals throughout the organization.

- Focusing sales efforts on key product groups serving specific, non-cyclical markets.

- Providing stronger customer service and communications.

- Pushing more ‘value-added’ products such as machined parts, sub-assemblies and assemblies.

- Adding manufacturing capacity.

- Introducing automation and other initiatives to improve product quality and consistency and to

reduce manufacturing costs. - Making strategic business acquisitions.

During the first year of Artemis Stewardship, MACT continues to advance its goal of maintaining its position as a highly trusted partner and leader in the high-performance advanced ceramics industry.

McDanel Advanced Material Technologies (MAMT)

2024-TODAY

In February 2024, MAMT announced a name change to support the strategic expansion of its materials capabilities. The new name, McDanel Material Technologies, aligned with the company’s goal to include a broader range of material technologies meant to extend MAMT’s expertise and broaden its reputation as a comprehensive materials solutions provider for a broad range of applications in the Aviation, Space, Defense, Medical and Pharma, Manufacturing and Research, and Semiconductor markets.

To further that goal, in March 2024, MAMT acquired Rayotek Scientific, the industry leader in single-source glass and sapphire solutions.